Previously, after state registration of an individual as an individual entrepreneur, tax authorities sent the relevant information to the territorial bodies of the Federal Statistics Service.

The entrepreneur had to receive the information letter from the statistical authorities about the assigned OKVED codes independently. To do this, he contacted the statistics agency and submitted copies of the certificate of state registration of the entrepreneur, the certificate of assignment of the TIN (or the certificate of registration with the tax authority and the assignment of the TIN).

Currently, in accordance with Decree of the Government of the Russian Federation dated February 26, 2004 No. 110 “On improving the procedures for state registration and registration of legal entities and individual entrepreneurs,” the obligation to issue (send) to business entities information about assigned them codes of all-Russian classifiers of technical, economic and social information. However, in practice, taxpayers continue to contact the territorial bodies of Rosstat to receive an information letter about the assigned statistics codes.

Starting from April 3, 2006, in Moscow there are regulations for the interaction of the registering (tax) authority (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46 for Moscow) with the Territorial body of the Federal State Statistics Service for Moscow (Mosgorstat) when implementing the procedure for state registration of legal entities individuals and individual entrepreneurs.

It describes the algorithm for interaction between the registration (tax) authority in Moscow and the Territorial body of the Federal State Statistics Service in Moscow (Mosgorstat) for assigning statistics codes, which is as follows:

1) MI Federal Tax Service of Russia No. 46 for Moscow makes a decision on state registration of an individual entrepreneur and makes a corresponding entry in the Unified State Register of Individual Entrepreneurs (USRIP) database;

2) MI Federal Tax Service of Russia No. 46 for Moscow no later than 10 o’clock the next day from the moment of making an entry in the Unified State Register of Individual Entrepreneurs (USRIP) database on the state registration of an individual entrepreneur, sends this information via communication channels to the Territorial body of the Federal State Statistics Service for Moscow (Mosgorstat ) for assigning codes according to all-Russian classifiers;

3) The territorial body of the Federal State Statistics Service for Moscow (Mosgorstat), based on the data received, carries out assignment according to all-Russian classifiers;

4) The territorial body of the Federal State Statistics Service for Moscow (Mosgorstat) submits to the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46 for Moscow documents confirming the assignment of codes according to all-Russian classifiers no later than the day following the day of receipt of information from the Unified State Register of Individual Entrepreneurs from the Interdistrict Inspectorate Federal Tax Service of Russia No. 46 for Moscow;

5) Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46 for Moscow prepares certificates of state registration of individual entrepreneurs, certificates of registration with the tax authority, extracts and forms a set of documents for subsequent issuance to the applicant with the inclusion of documents confirming the assignment of codes according to all-Russian classifiers. This must be done no later than the next day from the receipt of information from the Territorial Body of the Federal State Statistics Service for Moscow (Mosgorstat), documents confirming the assignment of codes according to all-Russian classifiers;

6) Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46 for Moscow issues documents on state registration the next day after the preparation of documents on state registration of an individual entrepreneur.

Information about OKVED codes of an individual entrepreneur is contained in the Unified State Register of Individual Entrepreneurs (subclause “p”, paragraph 2, article 5 of Law No. 129-FZ).

When registering as an individual entrepreneur, an individual must independently indicate the types of economic activities that he plans to carry out.

Types of economic activity according to OKVED are indicated by him when submitting an application for registration of an individual as an individual entrepreneur in form No. P21001, approved in Appendix No. 13 to Order of the Federal Tax Service of Russia dated January 25, 2012 No. MMV-7-6/25@.

Information about the types of economic activities is indicated in sheet A of form No. P21001.

Sheet A “Information on codes according to the All-Russian Classifier of Types of Economic Activities” is filled out taking into account the provisions of paragraph 2.16 of the Requirements for the execution of the Application for state registration of a legal entity upon creation (form No. P11001), approved by Order of the Federal Tax Service of Russia No. ММВ-7-6/25@.

In this case, codes are indicated according to the All-Russian Classifier of Types of Economic Activities OK 029-2001 (NACE Rev. 1). In sections 1 "Code of the main type of activity" and 2 "Codes of additional types of activity" at least four digital characters are indicated. If necessary, fill out several sheets of the application. In this case, section 1 is filled out only on the first sheet of the application.

It should be borne in mind that the Federal Tax Service of Russia considers it possible to use only the All-Russian Classifier of Types of Economic Activities OK 029-2001 (NACE Rev. 1), put into effect by the Decree of the State Standard of Russia dated November 6, when carrying out the functions of state registration of legal entities and individual entrepreneurs 2001 No. 454-st from January 1, 2003, and recommends that registration (tax) authorities convey this position to business entities.

Taking into account the above, the registering authority, upon receipt of documents for state registration in which information about types of economic activities is filled out using the All-Russian Classifier of Types of Economic Activities OK 029-2007 (NACE Rev. 1.1), has the right to decide to refuse state registration due to failure to submit documents specified by Law No. 129-FZ. This follows from the explanations of the Federal Tax Service of the Russian Federation, set out in the letter of the Federal Tax Service of the Russian Federation dated July 11, 2008 No. ChD-6-6/488@ "On the use of the All-Russian Classifier of Types of Economic Activities."

We recommend that an individual registering as an individual entrepreneur consider what may be more beneficial for him: either to provide the most complete information about the types of business activities he plans to carry out, or to indicate only the main types of activities that he plans to engage in.

A recommendation to more fully reflect the types of business activities planned for implementation can be given, in particular, to individuals who, after registering as individual entrepreneurs, plan to apply the simplified tax system. This is due to the fact that individual entrepreneurs using the simplified tax system are exempt from paying personal income tax (clause 24 of article 217 of the Tax Code of the Russian Federation). At the same time, they can pay tax in connection with the application of the simplified tax system in the amount of 6% (if they choose the object of taxation “income”). If an individual entrepreneur carries out activities outside the scope of the types of activities specified by him during registration, the income that he receives from these types of activities will be subject to personal income tax (i.e. at a rate of 13%). This follows, in particular, from letters of the Ministry of Finance of the Russian Federation dated August 13, 2013 No. 03-11-11/32808, dated May 19, 2011 No. 03-11-11/131, dated January 27, 2011 No. 03-11- 11/16, dated August 12, 2010 No. 03-04-05/3-453).

At the same time, if an individual registered as an individual entrepreneur indicates the maximum possible number of types of business activities that he will carry out and apply the simplified tax system to them (for example, even such type of activity as receiving income from the rental of his real estate), then it will not be able to take advantage of either the social, standard or property tax deduction for personal income tax if it has no other income subject to personal income tax tax at a rate of 13%.

An individual who did not have income during the year on which personal income tax was paid, and who received income from activities for which the simplified tax system is used for taxation, has no grounds for receiving tax deductions for personal income tax. This follows, in particular, from the explanations set out in the letters: Federal Tax Service of the Russian Federation dated November 11, 2011 No. ED-2-3/859@, Ministry of Finance of the Russian Federation dated May 6, 2011 No. 03-04-05/3-335, Ministry of Finance of the Russian Federation dated October 4, 2010 No. 03-04-05/3-584.

EXAMPLE

An individual entrepreneur applies the simplified tax system with the object of taxation “income” (6%). When registering with the state as an individual entrepreneur, he stated that his main activity was the rental of his own residential and non-residential real estate.

An individual entrepreneur owns several apartments, which he rents out, receiving monthly rent into his bank account. Subsequently, the individual entrepreneur decided to sell one apartment. What tax does he need to pay in this regard - tax when applying the simplified tax system or personal income tax?

An individual entrepreneur must pay tax in connection with the application of the simplified tax system. In this case, he must meet the following conditions:

1. during state registration, the entrepreneur had to indicate, for example, such types of activities as “70.12.1” (purchase and sale of own residential real estate), “70.12.2” (purchase and sale of own non-residential buildings and premises);

2. the property belonging to the entrepreneur was used by him in activities transferred to the simplified tax system, on which he paid tax at a rate of 6%.

It is in this case that income from the sale of an apartment will be classified as income from the sale of property used in business activities, and not as income from the sale of personal property.

It is if the specified conditions are met that the person will pay tax under the simplified tax system at a rate of 6%, and not personal income tax at a rate of 13%.

Also from paragraph 24 of Art. 217 of the Tax Code of the Russian Federation it follows that individual entrepreneurs are exempt from paying personal income tax in relation to those types of activities for which they are payers of UTII. It should be taken into account that the indication by an individual in the application for state registration as an individual entrepreneur of the type of activity proposed to be carried out does not mean that this individual entrepreneur is obliged to apply the taxation system in the form of UTII and submit tax returns for UTII. The use of UTII is subject to compliance with the following legal requirements:

– individual entrepreneurs carrying out activities falling under UTII are required to register with the relevant tax authority by submitting an application for registration as a UTII taxpayer within 5 days from the date of commencement of such activities;

– the occurrence of an obligation for taxpayers to submit a tax return for UTII is associated with the actual implementation of types of business activities that are subject to the taxation system in the form of UTII.

But if an individual entrepreneur, when registering in this capacity, indicates other types of business activities that will not fall under UTII and for which he will not carry out activities, then in this case, according to the opinion of the Federal Tax Service of the Russian Federation, set out in a letter dated April 26, 2011 No. AS-4-3/6753, an individual entrepreneur will be required to submit tax returns under the general taxation regime.

We also recall that until 2011, the legislation did not provide for the obligation of individual entrepreneurs to notify the registration authorities in the event of a change in the list of previously declared types of activities. Thus, in the previously valid paragraph 5 of Art. 5 of Law No. 129-FZ it was stated that an individual entrepreneur within three working days from the date of change specified in paragraph 2 of Art. 5 of Law No. 129-FZ information (except for the information specified in clauses “m” “r” clause 2 of Article 5 of Law No. 129-FZ) was obliged to report this to the registration authority at the place of his location and residence . Information about OKVED codes is specified in paragraphs. "o" clause 2 art. 5 of Law No. 129-FZ.

Federal Law of July 27, 2010 No. 227-FZ "On amendments to certain legislative acts of the Russian Federation in connection with the adoption of the Federal Law "On the organization of the provision of state and municipal services" in paragraph 5 of Article 5 of Law No. 129-FZ words “except for the information specified in paragraphs “m”, “p” were replaced by the words “except for the information specified in paragraphs “m”, “n”, “p”. In 2011, the obligation of entrepreneurs was established to report this fact to the registration authority within three working days from the moment of changing the OKVED codes (Clause 5 of Article 5 of Law No. 129-FZ).

Please note that the transition period associated with the planned abolition of OKVED has been extended until January 1, 2016. Cancellation of OKVED (OK 029-2001 (NACE Rev. 1)) can be carried out from January 1, 2016 (clause 2 of Rosstandart Order No. 14-st dated January 31, 2014 “On the adoption and implementation of the All-Russian Classifier of Economic Activities ( OKVED2) OK 029-2014 (NACE Rev. 2) and the All-Russian Classifier of Products by Type of Economic Activities (OKPD2) OK 034-2014 (KPES 2008)".

In paragraph 1 of the above Order, Rosstat indicated that the All-Russian Classifier of Types of Economic Activities (OKVED2) OK 029-2014 (NACE Rev. 2) and the All-Russian Classifier of Products by Type of Economic Activities (OKPD2) OK 034-2014 (KPES 2008) were adopted with the date of implementation was February 1, 2014, with the right of early application in legal relations arising from January 1, 2014, with the establishment of a transition period until January 1, 2016 and the subsequent cancellation of the All-Russian Classifier of Types of Economic Activities (OKVED) OK 029-2001 (NACE Rev. 1), All-Russian Classifier of Types of Economic Activities (OKVED) OK 029-2007 (NACE Rev. 1.1), All-Russian Classifier of Types of Economic Activities, Products and Services (OKDP) OK 004-93, All-Russian Classifier of Products by Type of Economic Activities (OKPD) OK 034-2007 (CPES 2002), the All-Russian Classifier of Services to the Population (OKUN) OK 002-93 and the All-Russian Classifier of Products (OKP) OK 005-93.

Until this point, for the purposes of state registration, OKVED OK 029-2001 (NACE rev. 1) continues to be used (letter of the Federal Tax Service of Russia dated August 7, 2014 No. ND-3-14/2624 “On the application of the All-Russian Classifier of Types of Economic Activities OK 029-2014” ).

After developing, in the prescribed manner, transitional keys between OKVED OK 029-2014 (NACE rev. 2) and OKVED OK 029-2001 (NACE rev. 1), the Federal Tax Service of Russia plans, without the participation of registered persons, to ensure that information on types of economic activities is entered into the relevant register in accordance with OKVED OK 029-2014 (NACE rev. 2).

When registering an LLC, the founders indicate in the charter what economic activity their company will be engaged in. In the application R11001 and the Unified State Register of Legal Entities entry sheet, which the tax inspectorate issues after the creation of the company, the types of activities are indicated using digital designations or OKVED codes. So, the codes of a construction organization will be the following OKVED 2 codes: 41.10, 41.20, 43.11, 43.12, 43.29 and others.

If, during the course of its activities, an organization decides to change its type of activity to one that was not specified during registration, then it is necessary to add OKVED codes for the LLC. It is quite possible to change or add OKVED codes yourself. To help you understand the procedure for changing the OKVED codes of a company, we have compiled this step-by-step instructions for changing the types of activities of an LLC in 2019.

We invite you to study with us step by step how to change OKVED (All-Russian Classifier of Activities) codes for an LLC.

Step 1. Select codes from the current edition of OKVED

OKVED is a document developed by Rosstandart, and in 2019 only one edition is in force - OKVED OK 029-2014 or OKVED 2. But on the Internet you can still find two other editions of the Classifier that are no longer used - OKVED OK 029-2001 and OKVED OK 029-2007.

If you indicate the wrong OKVED code classifier in your application, you will be denied registration. On our website you can find current ones.

If you find it difficult to select new OKVED codes for an LLC in 2019, we recommend that you get a free consultation with professional registrars, where they will answer your questions that arise when selecting new codes.

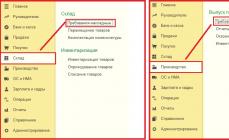

Step 2. Select an application form to submit information about changing types of OKVED

If a change in OKVED codes in an organization entails a change in the charter, then fill out the form. For example, your charter contains the following closed list of activities:

- wholesale;

- cargo transportation;

- forwarding activities.

At the same time, there is no phrase in the charter that allows the organization to engage in other types of activities not prohibited by the legislation of the Russian Federation. Let's say you opened a grocery store, which means the new OKVED code will be associated with retail trade. This type of activity is not on the list, and the charter does not stipulate the possibility of engaging in other permitted activities. In this case, changing the OKVED codes will require changing the charter and paying a state fee in the amount of 800 rubles.

Changing OKVED codes without making changes to the charter is formalized by an application and does not require payment of a state fee.

You have only three working days from the moment the corresponding decision is made to inform the Federal Tax Service about a change in OKVED codes, otherwise you risk receiving a fine of 5,000 rubles under Art. 14.25 Code of Administrative Offenses of the Russian Federation.

Step 3. Prepare the decision of the sole participant or the minutes of the general meeting on changing the OKVED codes of the company

The introduction of additional OKVED codes for an LLC falls within the competence of the company’s participants (single or general meeting), therefore it is necessary to prepare a decision that will address the following issues:

- Addition and/or exclusion of OKVED codes. If the main OKVED code of an organization changes, then this must be written separately. Both the main and additional OKVED codes in the decision are written in the form of numbers, and not as a description of the new type of activity. For example, when opening a bakery store, the decision must indicate code 47.24.

- Amendments to the charter in connection with the addition of new types of LLC activities that are not provided for in the constituent document (only if there is such a need).

- Approval of the authority of the person responsible for processing changes to OKVED codes. As a rule, the applicant in this case is the director of the LLC, but it can also be any other person acting by proxy.

Do not forget that from the date of making the decision or drawing up the minutes of the general meeting of participants, the countdown of three working days begins, during which documents must be submitted to the tax office to register the changes.

Step 4. Fill out and notarize the application for changing OKVED codes

It is necessary to have an application in form P13001 or P14001 certified by a notary, regardless of whether the director personally submits documents to the Federal Tax Service, sends them by mail, or passes them through a proxy.

Step 5. Submit documents on changing the company’s OKVED codes to the Federal Tax Service

Documents on new types of activities of the LLC, on the basis of which changes will be made to the Unified State Register of Legal Entities, must be submitted to the tax office that registered the company. In large cities, the registering Federal Tax Service differs from the one where the organization is registered. For example, in Moscow this is only the 46th tax inspectorate. You can also submit documents to the MFC, which, on the basis of Art. 9 (3) of Law No. 129-FZ independently transfers documents to the registration authority.

The package of documents for changing OKVED codes for an LLC when changing the charter includes:

- Participant's decision or minutes of the general meeting;

- A statement certified by a notary in form P13001;

- New edition of the charter or annex to the charter in two copies;

- Document confirming payment of state duty (when amending the charter) in the amount of 800 rubles.

You can prepare a payment order to pay the state duty on the official website of the Federal Tax Service. Please note that the KBK of payments when submitting documents to the tax office differs from the KBK when submitting to the MFC.

If no changes have been made to the charter, then to register a change in OKVED codes, only an application in form P14001 is submitted. As for the decision or protocol, although according to Law No. 129-FZ (Article 17(2)) it is not required to be submitted, the tax authorities still request it in order to make sure that the three-day deadline for filing documents is met.

Step 6. Receive documents confirming the introduction of changes to OKVED codes in the Unified State Register of Legal Entities

Five working days after submitting the documents, you must receive from the registration authority a new sheet of the Unified State Register of Legal Entities, where the changed OKVED codes will be indicated. If you submitted a new version of the charter or an appendix to it, then you will also be given one copy of the constituent document marked INFS.

This completes our step-by-step instructions on changing OKVED codes for LLCs. To reduce the risks of refusal to register changes, we recommend that before adding OKVED codes for an LLC in 2019, prepare all the necessary documents (decision or protocol, new edition of the charter, statement P13001 or P14001) in.

You will spend only a few minutes on this, and the documents will be prepared correctly and in compliance with all legal norms. You can learn how to work with the document and agreement designer in our service from this page.

After an enterprise or entrepreneur completes the state registration procedure, it is assigned specific statistics codes. The registration of a registered person is recorded in a notification provided by Rosstat.

Typically, such a notification is issued upon registration of a legal entity or individual entrepreneur, but if necessary, statistics codes can be obtained for free on the official website of Rosstat online, and then you can print out the notification yourself.

Statistics codes

Economic activity within the Russian Federation is divided into types. Each direction receives one number. With its help, information is classified and systematized regarding an individual entity engaged in business activities. Codes are assigned immediately after state registration procedures.

Types of classifiers

The types of different classifiers include:

OKPO

Using this eight to ten digit number, it is easy to determine which industry the enterprise belongs to.

OKATO

It is easy to find out the location of the enterprise. The number has from 8 to 11 digits, which are used to gradually indicate territorial affiliation.

OKTMO

These numbers help speed up the processing of received information.

OKOGU

Here 5 symbols serve for trouble-free systematization of information about government departments.

OKOPF

This combination is intended to determine the legal form. It facilitates the analysis of information, serves as the basis for forecasting economic processes and developing proportional recommendations.

OKVED

Necessary to determine the specific type of activity of an organization or individual entrepreneur.

The main purpose of the all-Russian classifier of types of economic activities (this is how OKVED stands for) is to classify and code the economic direction in which the activities of a registered person will be carried out.

This number is needed when collecting and analyzing information about activities in a certain area, to calculate the rates of collected taxes. Unlike other classifiers, legal entities and entrepreneurs select OKVED simultaneously with the collection of a full package of documents for registration.

Statistical codes are a specific digital combination from which you can obtain comprehensive information about an enterprise (as well as about an individual entrepreneur). All codes, grouped by class, are in one registry. Any number contains 5 or 6 digits. Using the codes, you can find out the main and additional types of work, regulate areas of the economy, and conduct statistical research.

What are they needed for

Statistics codes may be required when performing various actions, for example:

- participation in state tenders;

- opening new branches;

- changes in information about an individual entrepreneur (full name, registration);

- obtaining documents from the customs department;

- changes in legal address;

- renaming the company;

- passing audits;

- obtaining licenses;

- opening a current account;

- and others.

The statistics code base is updated regularly, usually twice a month. If notification was required earlier, even before the necessary information was entered into the database, you can act through the local branch of the State Statistics Service. It must be located in the same territory where the applicants were registered.

Statistics codes are required to track the registration with Rosstat of each entity engaged in business activities. Based on these codes, areas of enterprise operation are determined, classified and grouped.

Where and how to get

It's quite easy to get the information you need. You just need to choose one of several options:

- Simultaneously with state registration. An entrepreneur or legal entity receives a notification with statistics codes immediately, simultaneously with a package of other documentation.

- By contacting the territorial office of Rosstat. If tax inspectorate specialists have not issued the required notification, it is permissible to write a corresponding application to the statistics agency. It should be accompanied by copies of documents on state registration (they do not need to be certified), on the assignment of a TIN, as well as information from the Unified State Register. The founder’s responsibility is to provide a copy of the company’s Charter. Under this option, the notification will be issued no later than five working days.

- If you want to avoid unnecessary hassle, you can entrust obtaining information about the codes to a specialized law firm. True, a preliminary agreement will be required.

- There is an online service on the official website of the department that allows you to receive and print a notification with statistics codes for free.

How to obtain statistics codes by TIN online on the official website of Rosstat (step-by-step instructions)

In order to obtain statistics codes, you should perform the following steps on the official website of Rosstat of the Russian Federation:

Step 1. Go to the main page of the site - www.gks.ru.

Step 2. In the right sidebar of the site, click on the tab called “Notification about codes for all-Russian classifiers”

Step 3. A message will appear that the organization or individual entrepreneur has the opportunity to print information about codes according to all-Russian classifiers of technical, economic and social information (OK TEI) directly from the website when specifying the TIN or OGRN/OGRNIP in the search engine. To do this, follow the specified link - statreg.gks.ru.

Step 4. To generate a notification, enter the organization’s INN, captcha and click on the “Search” button

Step 5. In the search results, click on the “OK TEI Codes” button

Step 7. The received notification with statistics codes can be printed

Another option to obtain statistics codes by TIN on the official Rosstat website involves the following procedure.

Step 1. On the website, go to the section “About Rosstat” - “Territorial Bodies (TOGS)” - “TOGS Sites”

Step 2. Find on the map (or through a search) the desired territorial body of the Federal State Statistics Service and get a link to its website

Step 4. Click on the “Find out your OKPO code” tab

When generating, you need to select the desired type of notification, which can be for:

- legal entities;

- branches, representative offices, organizations that operate without forming a legal entity;

- individual entrepreneurs, heads of peasant (farm) farms;

- lawyers and private notaries.

This algorithm is suitable for all subjects. However, please be aware that this online service may not provide the service on weekends and holidays. You need to take care of receiving information in advance.

Note

Since the notification with statistics codes is an information and reference document, you can print it yourself. No special form of the organization, signature of an official or certification with a seal is required.

All legal entities and individual entrepreneurs must receive this data on time. There is no need to delay this procedure. Such information will be required immediately after starting business activities.

You can get statistics codes by TIN for free online, at. including with the formation of a document that will be quite sufficient for many of the authorities requesting these codes. Let's look at how this can be done.

Types of statistics codes and their application

Statistical codes are assigned to an economic entity at the time of its registration. Their complete set provides encrypted data about the main characteristics of the subject:

- its serial number in the general list (OKPO);

- belonging to a government body (OKOGU);

- the form in which it was created (OKOPF);

- ownership of his property to a specific owner or owners (OKFS);

- binding to the territory of the place of business (OKTMO);

- types of activities carried out (OKVED).

Specifying these codes is necessary when preparing reports of such types as:

- accounting;

- tax;

- statistical.

In addition, the bank requests statistical codes at the time of opening an account.

That is, these ciphers are in demand from the moment the subject is registered, and therefore obtaining statistics codes becomes an objective necessity for him.

Obtaining codes online for LLCs and individual entrepreneurs

Until 2016, information about assigned statistical codes was issued by Rosstat in the form of a certificate with the seal of this department, which contained all the codes characterizing the subject.

The picture has changed with the spread of electronic services. Now you can get statistics codes online using the INN, OGRN (OGRNIP) or OKPO of the subject for free, using the special service of Rosstat. Here a document will be generated that will list the necessary ciphers and reflect their decryption. If necessary, it can be printed. This document differs from the previously issued certificate:

- title - it is called a notification;

- lack of Rosstat seal;

- lack of OKVED codes.

OKVED codes are a mandatory component of the data reflected in the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs and will be shown in an extract from the corresponding register. It can also be generated electronically and printed for free by visiting the Federal Tax Service website. For a newly registered entity, these codes in the text of the extract (section “Information on types of economic activities”) will be issued on paper. And accordingly, they will be present in every paper copy of this document issued by the registration authority upon request for a fee.

The procedures for how to obtain statistics codes for an LLC and how to obtain statistics codes for an individual entrepreneur will not differ. You just need to choose the right person for whom the notification is intended on the Rosstat website (it allows 4 options for persons receiving this document) or go to the desired tab (there are 2 of them) on the Federal Tax Service website.

Data is updated on the Rosstat server daily, and the very next day after registering a new economic entity, it will be able to receive the statistical codes it is interested in.

Results

Stat codes in encrypted form reflect all the main characteristics of each of the registered economic entities (legal entity or individual entrepreneur). They are required to be indicated in accounting, tax and statistical reporting. The bank may also require codes when registering an account. You can find out statistical codes for free on a special Rosstat service using any of the unique codes belonging to a registered entity (TIN, OGRN (OGRNIP), OKPO). However, among them there will be no OKVED codes reflected in the Unified State Register of Legal Entities (USRIP). They can be found out by generating an extract from the relevant register on the Federal Tax Service website.